Contents

- 1.1 Introduction

- 1.2 Objectives

- 1.3 FICO scores

- 1.4 More than one score

- 1.5 Composition Of Your Score

- 1.6 What’s Not in Your Score

- 1.7 How Credit Scoring Helps You

- 1.8 Tips For Improving Your Score

- 1.9 What Your Grade and Credit Score Mean

- 1.10 Summary

Author:

Michael K. Swan, Washington State University

Reviewers:

Gary Thome, Riverland Community College;

Peter Scheffert, Riverland Community College

Introduction

Along with the credit report, lenders can also buy a credit score based on the information in the report. That score is calculated by a mathematical equation that evaluates many types of information that are on your credit report at that agency. By comparing this information to the patterns in hundreds of thousands of past credit reports, the score identifies your level of future credit risk.

In order for a FICO® score to be calculated on your credit report, the report must contain at least one account, which has been open for six months or greater. In addition, the report must contain at least one account that has been updated in the past six months. This ensures that there is enough information – and enough recent information – in your report on which to base a score.

Objectives

- Determine what are Credit Scores

- Identify the Composition Of Your Credit Score

- Determine What’s Not in Your Credit Score

- Identify How Credit Scoring Helps You

- Identify Tips For Improving Your Credit Score

- Determine What Your Grade and Credit Score Mean

FICO scores

Credit scores are often called “FICO scores” because most credit scores used in the United States are produced from software developed by Fair Isaac and Company. FICO scores are provided to lenders by the three major credit-reporting agencies:

- Equifax – (800) 685-1111 www.equifax.com

- Experian – (800) 397-3742 www.experian.com

- TransUnion – (800) 888-4213 www.transunion.com

FICO scores provide the best guide to future risk based solely on credit report data. The higher the FICO score, the lower the credit risk. However, no score says whether a specific individual will be a “good” or “bad” customer. And while many lenders use FICO scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable for a given credit product. There is no single “cutoff score” used by all lenders and there are several factors that lenders use to determine your actual interest rates.

More than one score

In general, when lenders talk about “your score”, they are talking about your current FICO score. However, there is no one score used to make decisions about you. This is true because:

- Credit bureau scores are not the only scores used. Many lenders use their own scores, which often will include the FICO score as well as other information about you.

- FICO scores are not the only credit bureau scores. There are other credit bureau scores, although FICO scores are by far the most commonly used. Other credit bureau scores may evaluate your credit report differently than FICO scores, and in some cases a higher score may mean more risk, not less risk as with FICO scores.

- Your score may be different at each of the three main credit reporting agencies. The FICO score from each credit reporting agency considers only the data in your credit report at that agency. If your current scores from the three credit reporting agencies are different, it’s probably because the information those agencies have on you differs.

- Your FICO score changes over time. As your data changes at the credit reporting agency, so will any new score based on your credit report. So your FICO score from a month ago is probably not the same score a lender would get from the credit reporting agency today.

Composition Of Your Score

FICO Scores are calculated from many different credit data in your credit report. This data can be grouped into five categories. The percentages in the chart reflect how important each of the categories are in determining your score. These percentages are based on the importance of the five categories for the general population.

Payment History

- Account payment information on specific types of accounts (credit cards, retail accounts, installment loans, finance company accounts, mortgage, etc.)

- Presence of adverse public records (bankruptcy, judgments, suits, liens, wage attachments, etc.), collection items, and/or delinquency (past due items)

- Severity of delinquency (how long past due)

- Amount past due on delinquent accounts or collection items

- Time since last past due items (delinquency), adverse public records (if any), or collection items (if any)

- Number of past due items on file

- Number of accounts paid as agreed

Amounts Owed

- Amount owing on accounts

- Amount owing on specific types of accounts

- Lack of a specific type of balance, in some cases

- Number of accounts with balances

- Proportion of credit lines used (proportion of balances to total credit limits on certain types of revolving accounts)

- Proportion of installment loan amounts still owing (proportion of balance to original loan amount on certain types of installment loans)

Length of Credit History

- Time since accounts opened

- Time since accounts opened, by specific type of account

- Time since account activity

New Credit

- Number of recently opened accounts, and proportion of accounts that are recently opened, by type of account

- Number of recent credit inquiries

- Time since recent account opening(s), by type of account

- Time since credit inquiry(s)

- Re-establishment of positive credit history following past payment problems

Types of Credit Used

- Number of (presence, prevalence, and recent information on) various types of accounts (credit cards, retail accounts, installment loans, mortgage, consumer finance accounts, etc.)

Important Note:

- A score takes into consideration all these categories of information, not just one or two.

- The importance of any factor depends on the overall information in your credit report.

- Your FICO score only looks at information in your credit report.

- Your score considers both positive and negative information in your credit report.

What’s Not in Your Score

FICO scores consider a wide range of information on your credit report. However, they do not consider:

- Your race, color, religion, national origin, sex and marital status.

- Your age.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Any interest rate being charged on a particular credit card or other account.

- Any items reported as child/family support obligations or rental agreements.

- Certain types of inquiries (requests for your credit report).

- Any information not found in your credit report.

- Any information that is not proven to be predictive of future credit performance.

- Whether or not you are participating in a credit counseling of any kind.

How Credit Scoring Helps You

Credit scores give lenders a fast, objective measurement of your credit risk. Before the use of scoring, the credit granting process could be slow, inconsistent and unfairly biased.

Credit scores—especially FICO® scores, the most widely used credit bureau scores—have made big improvements in the credit process. Because of credit scores:

- People can get loans faster. Scores can be delivered almost instantaneously, helping lenders speed up loan approvals. Today many credit decisions can be made within minutes. Even a mortgage application can be approved in hours instead of weeks for borrowers who score above a lender’s “score cutoff”. Scoring also allows retail stores, Internet sites and other lenders to make “instant credit” decisions.

- Credit decisions are fairer. Using credit scoring, lenders can focus only on the facts related to credit risk, rather than their personal feelings. Factors like your gender, race, religion, nationality and marital status are not considered by credit scoring.

- Credit “mistakes” count for less. If you have had poor credit performance in the past, credit scoring doesn’t let that haunt you forever. Past credit problems fade as time passes and as recent good payment patterns show up on your credit report. Unlike so-called “knock out rules” that turn down borrowers based solely on a past problem in their file, credit scoring weighs all of the credit-related information, both good and bad, in your credit report.

- More credit is available. Lenders who use credit scoring can approve more loans, because credit scoring gives them more precise information on which to base credit decisions. It allows lenders to identify individuals who are likely to perform well in the future, even though their credit report shows past problems. Even people whose scores are lower than a lender’s cutoff for “automatic approval” benefit from scoring. Many lenders offer a choice of credit products geared to different risk levels. Most have their own separate guidelines, so if you are turned down by one lender, another may approve your loan. The use of credit scores gives lenders the confidence to offer credit to more people, since they have a better understanding of the risk they are taking on.

- Credit rates are lower overall. With more credit available, the cost of credit for borrowers decreases. Automated credit processes, including credit scoring, make the credit granting process more efficient and less costly for lenders, who in turn have passed savings on to their customers. And by controlling credit losses using scoring, lenders can make rates lower overall. Mortgage rates are lower in the United States than in Europe, for example, in part because of the information – including credit scores – available to lenders here. Knowing and improving your score can also lead to more favorable interest rates. Check out an example of the national averages of interest rates and see exactly how much money you might be able to save.

Tips For Improving Your Score

It’s important to note that raising your score is a bit like losing weight: It takes time and there is no quick fix. In fact, quick-fix efforts can backfire. The best advice is to manage credit responsibly over time. See how much money you can save by just following these tips and raising your score.

Payment History

- Pay your bills on time.

- If you have missed payments, get current and stay current.

- Be aware that paying off a collection account will not remove it from your credit report.

- If you are having trouble making ends meet, contact your creditors or see a legitimate credit counselor.

Amounts Owed

- Keep balances low on credit cards and other “revolving credit”.

- Pay off debt rather than moving it around.

- Don’t close unused credit cards as a short-term strategy to raise your score.

- Don’t open a number of new credit cards that you don’t need, just to increase your available credit.

Length of Credit History

- If you have been managing credit for a short time, don’t open a lot of new accounts too rapidly.

- New Credit Tips

- Do your rate shopping for a given loan within a focused period of time.

- Re-establish your credit history if you have had problems.

- Note that it’s OK to request and check your own credit report.

Types of Credit Used

- Apply for and open new credit accounts only as needed.

- Have credit cards – but manage them responsibly.

- Note that closing an account doesn’t make it go away.

What Your Grade and Credit Score Mean

Each credit bureau has its own unique system that allows them to offer a score based solely on the contents of the credit bureau’s data about an individual. However, a numerical score at one bureau is the equivalent of the same numerical score at another. Thus, a score of 700 from Experian indicates the same creditworthiness as a score of 700 from Trans Union or Equifax, even though the calculations used to determine those scores are different at each bureau. The scores range from 375 to 900 points, and in general, a score of 650 or above indicates a very good credit history. Average FICO scores fall into the range between 620 and 650.

It must however be noted that not all lenders give same value to a particular credit score. Besides, not all lenders use credit scoring system and even when they do they may not use credit scoring system for all their loan programs.

The interest rate a lender will charge depends on these four main factors. If all the factors are great, the loan is assigned “A” grade and therefore qualifies for the best interest rate. If even one of the factors is not up to par, the quality of the loan is downgraded to A-, B, C, or D loan. D loans refers to what is known as hard money loans which are mostly based on the equity in your home and not on your credit. A lender who is making a B, C or D loan is taking a higher risk since there is an increased likelihood of the loan defaulting. The lender is compensated for higher risk by charging the borrower a higher interest rate:

A loans could have rates 1% – 1.75% higher than A loans

B loans could have rates 0.25% – 0.75% higher than A- loans

C loans could have rates 0.75% – 1.5% higher than B loans

D loans could have rates 1% – 1.75% higher than C loans

The interest rates quoted for A-, B, C or D loans, like for adjustable programs, could vary vastly from lender to lender.

Below are representative of the requirements used by many lenders, but are not absolute grades – lenders typically have similar but somewhat different specifications. These are only guidelines and may vary with lending institution or lending company.

Hog Producer 1: Low/average-risk person with good credit score

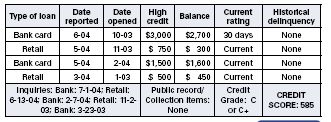

This profile presents a certain degree of risk for the lender. First, the payment history raises some concerns due to the collection item and serious delinquency on the second bank card. Because these items are a few years old, they do not raise the level of risk of concern as much as they would if they had occurred recently, but they do affect the score. The balances outstanding also represent a certain level of risk. Although only a fairly small portion of the available credit has been used, it is still higher than optimal. However, the long file history and lack of recent inquiries or credit line openings are positive indicators. This profile would probably represent an acceptable risk level to most credit grantors.

Hog Producer 2: High-risk person with poor credit score

Most lenders would agree that this profile represents a high level of risk. First, one of the bank cards was delinquent the last time it was reported. Although the delinquency is minor — only a 30-day rating — it points to potential risk, given that the file history is quite short. The ratio of balances to high credit is also indicative of significant risk. The balances are quite large relative to their high credit amounts and the amount of time the accounts have been open. Also telling is the fact that all trade lines have balances. This profile, along with the short file history, strongly contributes to the high-risk ranking.

Summary

Increasingly, credit scores are being used for purposes other than determining whether you will default on a loan or make late payments. For example, some insurers are using low credit scores as indicators to identify individuals they believe are more likely to make claims against their insurance policies. These insurance companies maintain that there is a correlation between poor credit and filing multiple insurance claims. An accurate credit score can make the difference not only in interest rates charged on loans, but also on the availability and cost of insurance, and many other items essential for most families.

References:

http://www.myfico.com/myfico/creditCentral

http://www.transunion.com/content/